57+ can you write off mortgage interest on a rental property

Web Up to 25 cash back mortgage interest payments to financial institutions on loans used to improve rental property. Ad Chat Online Right Now with a Tax Expert and Get Info About Tax-Deductible Donations.

Is Your Mortgage Considered An Expense For Rental Property

Web Interest on home equity loans and lines of credit are deductible only if the borrowed funds are used to buy build or substantially improve the taxpayers home that secures the loan on Publication 936 on page 2.

. Web Key Takeaways. LawDepot Has You Covered with a Wide Variety of Legal Documents. 22 suspends from 2018 until 2026 the deduction for interest paid on home equity loans and lines of credit unless.

Ask a Tax Expert for Info Now About How to Write-Off Mortgage Interest in a Private Chat. Web Mortgage balances for rental property usually equal several hundred thousands of dollars. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage.

Please send me a link or paragraph that states HELOC or equity loan interest can be deducted. Web In TT when you enter mortgage interest in rental section it says TurboTax will allocate your personal portion of qualified interest over to the deduction section for. Web The costs associated with obtaining a mortgage on rental property are amortized spread out over the life of the loan.

You paid 4800 in. The terms of the loan are the same as for other 20-year loans offered in your area. Create Your Satisfaction of Mortgage.

Lenders generally require a 20 to 25 percent down payment to purchase a one- to four. Ad How Much Interest Can You Save by Increasing Your Mortgage Payment. Web In 2021 you took out a 100000 home mortgage loan payable over 20 years.

Other refinance-related expenses not directly related to the mortgage may also be deductible. Ad Developed by Lawyers. There are many tax benefits of owning a rental property including a depreciation deduction mortgage interest deduction as well as other.

Web The Tax Cuts and Jobs Act of 2017 enacted Dec. Interest on credit cards for goods or services used in a rental. For example if it cost you 3000 to refinance your 30-year mortgage youd be able to deduct 100 per year for the next 30 years.

Deduction Of Mortgage Interest On Rental Property

Haven Central North Florida December 2022 By Havenlifestyles Issuu

57 Residential Property In Chennai Residential Apartments Flats Houses For Sale In Gerugambakkam Chennai Justdial Real Estate

Can You Deduct The Difference From Rent To Mortgage Payments For A Rental Property

Is Your Mortgage Considered An Expense For Rental Property

57 Business Ideas In Surat For 2023 Untapped Business Ideas

57 Residential Property In Chennai Residential Apartments Flats Houses For Sale In Gerugambakkam Chennai Justdial Real Estate

Everybody Should Buy More Rental Property

57 Property In Ernakulam Apartments Flats Houses Offices For Sale In Poothotta Ernakulam Justdial Real Estate

Rim Country Review Real Estate More September 22 By Rim Country Review Magazine Issuu

Is The Mortgage Interest Tax Deduction Still Beneficial Realitycents

Farm What To Write Off On Your Rental Property

Vacation Home Rentals And The Tcja Journal Of Accountancy

Can I Write Off Mortgage Payments On Rental Properties Solve Report

Difference Between Mortgage Interest Deductible For A Rental Owner Occupied

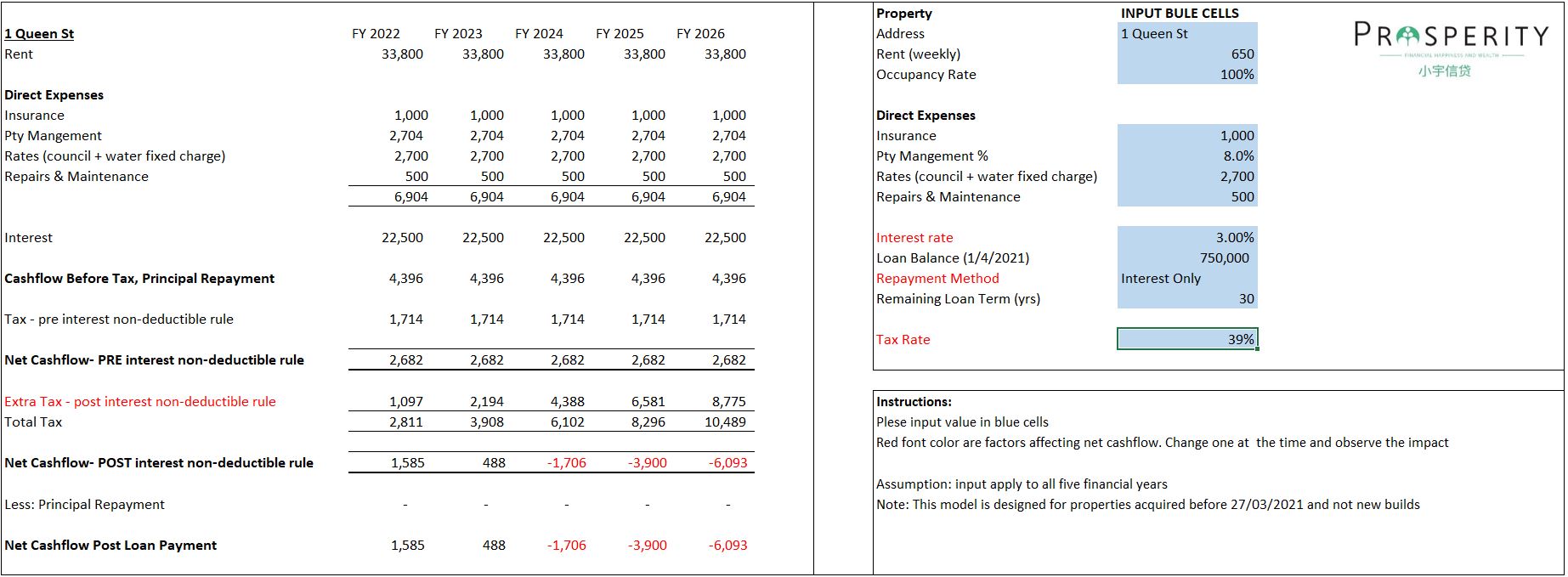

New Housing Policy 2021 No Interest Deductions On Residential Rental Property

Buy To Let Mortgage Interest Tax Relief Explained Which