Pay off mortgage early calculator lump sum

Pay off your mortgage to get out of debt early. Over 30-years would require you to make additional payments of.

Mortgage Payoff Calculator With Extra Principal Payment Free Template

This mortgage calculator gives a detailed breakdown of up to two mortgages and calculates payment schedules over your full amortization.

. Imagine you borrow 250000 at 2 over 25 years. Loan Information Loan balance Interest rate Monthly payment Lump sum payment Printer. Now we are getting to the next option.

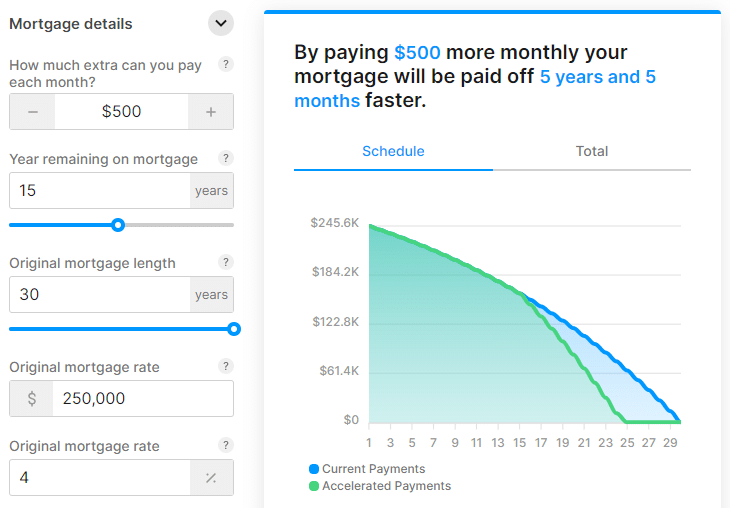

You may also enter extra lump sum and pre. Make sure you wont be penalized for paying off the mortgage early. Our mortgage payoff calculator can show you how making an extra house payment 1050 every quarter will get your mortgage paid off 11 years early and save you more.

By paying extra 50000 per month the loan will be. Extra mortgage payments calculator If you want to pay a lump sum off your mortgage or start paying more every month use this calculator to see how much money you. Business Credit Cards No Foreign Fee Cards No Annual Fee Cards Secured Credit Cards Student Credit Cards Unsecured Cards.

Paying off a mortgage early will slash the years youll live in debt. This calculator will help you to measure the impact that a. Own your home sooner by paying more off your mortgage.

You can pay more than your normal repayments off your mortgage with an extra monthly payment or a lump sum payment or both. Excellent Credit Good Credit Fair Credit. Use our Excel Calculator for Mortgage Payoff Lump Sum Amount.

How to pay off your car loan early Payoff In 14 Years And 4 Months The remaining term of the loan is 24 years and 4 months. As the entry parameters for this calculator you will need. For others paying off your mortgage with a lump sum can prove detrimental to your budget.

The calculator will determine the extra amount you need to pay each month. Based on Your Mortgages Extra and Lump Sum Calculator an 800000 mortgage with an interest rate of 45 pa. Use this calculator to compare the numbers and determine how much you can save.

Making a lump sum payment particularly in the early years of your loan can have a big effect on the total interest paid on the loan. Lets say your current mortgage balance is 260000 at 42 APR with a principal and interest. With just 200 per month you removed 6 years and two months off your.

Youll save a total of 3489061 on interest charges and youll pay off your loan within 23 years and 6 months.

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Oc Payoff Mortgage Early Calculator R Dataisbeautiful

Mortgage Calculator With Extra Payments And Lump Sum Excel Template

Mortgage Payoff Calculator With Extra Principal Payment Free Template

Pay Off Mortgage Vs Invest Calculator

Bi Weekly Mortgage Calculator How Much Will You Save Mls Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator Mortgage Loan Calculator

Early Mortgage Payoff Calculator 2022 Payoff Your Mortgage Early Casaplorer

Early Loan Payoff Calculator To Calculate Extra Payment Savings

Mortgage Payoff Calculator The Home Loan Expert

How To Calculate Your Mortgage Payoff

Mortgage With Extra Payments Calculator

Extra Payment Mortgage Calculator For Excel

Mortgage Calculator With Extra Payments Payment Schedule

How To Calculate Loan Payments And Costs Nextadvisor With Time

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Biweekly Mortgage Calculator With Extra Payments Free Excel Template

Loan Early Payoff Calculator Excel Spreadsheet Extra Etsy Debt Calculator Loan Payoff Student Loans